100melochei.ru

Gainers & Losers

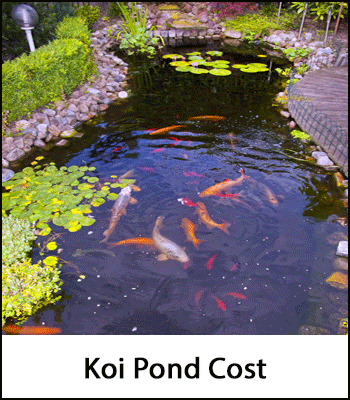

Pond Prices

Learn about the average cost of installing a garden pond. See pond price estimates from professionals in Texas, California and New York. Specialty projects, like installing a koi pond or digging a swimming pool, can run $5, to $, or more. Artificial lakes can cost up to $15, per acre. IDEA & PRICE GUIDE ; Ecosystem Pond Packages · The Lily Pad. Starting at $8, · The Lotus. Starting at $14, ; Disappearing Waterfall Packages · The Dragonfly. Rates for the Poncho's Pond RV Park season! Upgrade to 20′ x 25′ pond with 2′ high, sheer drop waterfall. • Aquascape Signature Series skimmer and biofilter. Upgrade to 11 tons of Premium Moss boulders. Selecting a site, soil questions, building a dam, creating habitat, renovating a pond or lake, photo gallery, uploading photos, image gallery. Pond Packages · ASK US ABOUT FINANCING · Serenity Pond · 8'x11' Serenity Pond · Base Price $12, · Additional Add-Ons · Oasis Pond · 10'x14' Oasis Pond. Earth Pond. $Price. Size. Select, Mineral, Medium, Large, X-Large, Mega. Quantity Mineral Pond, 42" x 42" x 10", 50 lb Cap. Medium Pond, 47" x 47" x 10". An Ecosystem Pond works with nature to achieve a naturally beautiful water feature. Enjoy crystal-clear water and happy, healthy fish – without a lot of work. Learn about the average cost of installing a garden pond. See pond price estimates from professionals in Texas, California and New York. Specialty projects, like installing a koi pond or digging a swimming pool, can run $5, to $, or more. Artificial lakes can cost up to $15, per acre. IDEA & PRICE GUIDE ; Ecosystem Pond Packages · The Lily Pad. Starting at $8, · The Lotus. Starting at $14, ; Disappearing Waterfall Packages · The Dragonfly. Rates for the Poncho's Pond RV Park season! Upgrade to 20′ x 25′ pond with 2′ high, sheer drop waterfall. • Aquascape Signature Series skimmer and biofilter. Upgrade to 11 tons of Premium Moss boulders. Selecting a site, soil questions, building a dam, creating habitat, renovating a pond or lake, photo gallery, uploading photos, image gallery. Pond Packages · ASK US ABOUT FINANCING · Serenity Pond · 8'x11' Serenity Pond · Base Price $12, · Additional Add-Ons · Oasis Pond · 10'x14' Oasis Pond. Earth Pond. $Price. Size. Select, Mineral, Medium, Large, X-Large, Mega. Quantity Mineral Pond, 42" x 42" x 10", 50 lb Cap. Medium Pond, 47" x 47" x 10". An Ecosystem Pond works with nature to achieve a naturally beautiful water feature. Enjoy crystal-clear water and happy, healthy fish – without a lot of work.

The cost for a true swimming pond can range from about $65, to $, and higher. Smaller swim ponds cost an average of $70, The average size swimming. Lazy rivers can also be added to any existing pond. You nay even want in island in the middle of the pond with a fire pit. Your imagination can go anywhere but. PONDS & POND ACCESSORIES · Get It Fast · Availability · Department · Review Rating · Brand · Price · Customers Ultimately Purchased · Recently Viewed. The cost of a swimming pond can vary depending on a number of factors, including the size and location of the pond, as well as the type of materials used to. Expect to pay between $ and $ per cubic yard for larger ponds. For smaller, hand-dug options, costs are about $ to $ a square foot for the labor. Perennial Water Plants Contractor Rate For All 1-Gallon Plants: $ All Prices for 1 Gallon Plants. For 2 and 5 Gallon Plants, Call or Email for Pricing. The cost of a custom koi pond will depend on the size and features you want to include. Nationally speaking, the total cost can be anywhere from $1, to. It can be extremely difficult to determine how much it will cost to dredge a pond without a professional evaluation and in-depth planning. Collect Pond, or Fresh Water Pond, was a body of fresh water in what is The project had cost $ million. Although the park was popular among. Aquascape is a leading innovator in pond kits, koi pond kits, and water garden kits Sort by price: low to high; Sort by price: high to low. Default sorting. We build ponds for any budget size and yard. Our packages start at $12, and are with the latest technology, equipment, & construction methods by friendly. AZPonds and Supplies, Inc. has been in the pond supply business for over 20 years. Our clients are from all over the USA and include Do-It-Yourselfers. Learn about the DIY pond cost and professional installation prices in Ann Arbor. Find out how to budget for the perfect pond for your backyard paradise. The cost of a custom koi pond will depend on the size and features you want to include. Nationally speaking, the total cost can be anywhere from $1, to. Dreaming of a backyard koi pond? Discover the true koi pond cost in Maryland with Premier Ponds and embark on your journey to a serene backyard paradise. Koi ponds are some of the most common fish ponds. The cost of building a koi pond will vary depending on the pond size and how many fish you intend to add. The. It can be extremely difficult to determine how much it will cost to dredge a pond without a professional evaluation and in-depth planning. Find pricing and packages for koi ponds. To schedule an appointment, contact us at Specialty projects, like installing a koi pond or digging a swimming pool, can run $5, to $, or more. Artificial lakes can cost up to $15, per acre.

How Much Is Average Car Insurance A Month

How much is the average cost of car insurance each year? Generally speaking, the average cost is about $1, However, this number can only tell drivers so. Adding a year-old to an adult's policy costs on average $ per month, according to Investopedia research. The cost of car insurance for teens depends. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. Average Insurance Rates by Vehicle According to the first table above, the cheapest vehicles to insure in Palm Springs are usually cars, at $43 per month. Car insurance premiums are based in part on the car's price, the cost to repair it, its overall safety record and the likelihood of theft. Many insurers offer. On average, the car insurance cost for a year-old is $ a month. The rates vary by coverage, carriers, vehicle, & other rating factors. Get quotes! Last year, the average cost of car insurance for individuals in the US was around $1, per year. This can vary a lot depending on factors like. The national average cost of car insurance in is roughly $ per year (or $64 per month).* This average rate is for a minimum coverage policy—meaning. Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an. How much is the average cost of car insurance each year? Generally speaking, the average cost is about $1, However, this number can only tell drivers so. Adding a year-old to an adult's policy costs on average $ per month, according to Investopedia research. The cost of car insurance for teens depends. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. Average Insurance Rates by Vehicle According to the first table above, the cheapest vehicles to insure in Palm Springs are usually cars, at $43 per month. Car insurance premiums are based in part on the car's price, the cost to repair it, its overall safety record and the likelihood of theft. Many insurers offer. On average, the car insurance cost for a year-old is $ a month. The rates vary by coverage, carriers, vehicle, & other rating factors. Get quotes! Last year, the average cost of car insurance for individuals in the US was around $1, per year. This can vary a lot depending on factors like. The national average cost of car insurance in is roughly $ per year (or $64 per month).* This average rate is for a minimum coverage policy—meaning. Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Drivers with minimum coverage pay an.

Find out how much car insurance costs based on your age and state. Average car insurance rates by age group range from $ per year for year-old drivers. Nationwide, auto insurance averages $ per month for full coverage and $ per month for liability-only coverage. But premiums depend on various factors. Los Angeles Auto Insurance Premiums by Driver Age · Teenagers: $9, · 20s: $3, · 30s: $2, · 40s: $2, · 50s: $2, · 60s: $2, · 70s: $2, car insurance premiums and learn ways to help lower insurance costs. You pay insurance deductible and coverages, the specifics play a role in your monthly. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. Full coverage auto insurance for an Outlook comes in at about $ monthly, on average, while liability only insurance usually runs around $75 per month. Hugo. Get estimated prices on health plans before you apply. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final. The average monthly car insurance premium in California is $ for full coverage and $ for liability-only coverage. California's average rates are lower. car insurance can help pay medical bills, vehicle repairs and legal defense costs. How much is car insurance per month? Many factors including your location. Car insurance quotes online in under 10 minutes. Discounts to get you the savings you're looking for. Start your auto quote to see how much you could save. On average, the car insurance cost for a year-old is $ a month. The rates vary by coverage, carriers, vehicle, & other rating factors. Get quotes! In the United States, the average cost of full coverage car insurance is $ per year, or $ per month. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month.1 Keep. The average cost of car insurance for a 6-month policy is $, whereas drivers who purchase car insurance for a period of 12 months pay $1,, based on a. The average car insurance rate in Florida is $1, per year — % more than the U.S. average. But auto insurance prices are dictated by factors other than. Average Cost of Car Insurance by State ; Oklahoma. $ $ ; Oregon. $ $ ; Pennsylvania. $ $ ; Rhode Island. $ $ Since health care costs vary throughout California, regional pricing adjusts insurance (percentage of charges). You must usually meet an annual. Car insurance companies see drivers with a bad driving history has being a bigger risk. Drivers in Virginia with a good driving history usually pay around. But if you need to avoid unexpected costs, you might prefer a lower deductible and higher premium. How are car insurance premiums calculated? Car insurance. Credit. Car insurance companies usually use a person's credit when setting rates—except in California, Hawaii, Massachusetts and Michigan. The use of a credit.

Is Settling Debt Good

Settling credit card debt can be a good way to get out of debt, but it can also have a negative impact on your credit score. Learn how to minimize the. 1. Avalanche technique Avalanche technique is to settle debts that have high interest rates such as credit cards and personal debts first. It's a long process with no guaranteed results — but it will almost certainly tank your credit. Consider other options before turning to debt settlement, and. Paying a settled debt amount clears the debt but may temporarily lower your credit score, and the forgiven debt is taxable. This is either a 'full balance' or 'partial' settlement depending on how much you can pay back. You might be able to use a lump sum from: Get debt advice to. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. Settling debt can relieve you of some of your obligations, but there are also downsides to consider, such as how it may affect your credit score. Here is what. If your financial situation is so difficult that you can't make any payment on your debt, debt settlement is not a good option. You need to be able to offer. It literally doesn't matter and if on the off-chance it does, what? a point or two - which you'll recover with good credit behavior. When you. Settling credit card debt can be a good way to get out of debt, but it can also have a negative impact on your credit score. Learn how to minimize the. 1. Avalanche technique Avalanche technique is to settle debts that have high interest rates such as credit cards and personal debts first. It's a long process with no guaranteed results — but it will almost certainly tank your credit. Consider other options before turning to debt settlement, and. Paying a settled debt amount clears the debt but may temporarily lower your credit score, and the forgiven debt is taxable. This is either a 'full balance' or 'partial' settlement depending on how much you can pay back. You might be able to use a lump sum from: Get debt advice to. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment. Settling debt can relieve you of some of your obligations, but there are also downsides to consider, such as how it may affect your credit score. Here is what. If your financial situation is so difficult that you can't make any payment on your debt, debt settlement is not a good option. You need to be able to offer. It literally doesn't matter and if on the off-chance it does, what? a point or two - which you'll recover with good credit behavior. When you.

When is Debt Settlement a Good Idea? · It eliminates the threat of a lawsuit, which might force you to pay your full balance. · Paying what you owe is simply the. Credible Takeaways · Debt settlement can help you settle your debt for less than owe. · Debt that's written off could be considered taxable income. · Other ways to. Debt settlement can help improve your score if you have been late on repayments to this point. We don't advise however that you use it to settle debts that have. As you settle your debts, your credit score should start to recover. Dalton G. Dalton, Professional, Enjoys riding his motorcycle. “National Debt Relief put. Debt Settlement is not a good debt relief option for everyone. Weighing the pros & cons of debt settlement can help you decide if it is a good idea for you. Consolidating debt won't keep you from taking on more debt than you can handle in the future. The best way to stay on track financially is to develop good money. It's a long process with no guaranteed results — but it will almost certainly tank your credit. Consider other options before turning to debt settlement, and if. Payment history is the most crucial credit score factor, so multiple late payments might very well tank your credit. And even if the negotiation is successful. Debt settlement works by allowing you to pay off your credit card debt or loan debt at a lower amount. You must come to an agreement with the lender or credit. If your credit score is already bad, there's less risk to settling your debt. On the other hand, if you have a good score – or even a fair one – then you. It generally helps to show as paid in full, as also more debt collectors will remove the item from your credit report if you do that. Not always. Paying off a debt in its entirety stops all collection calls for good. Debt collectors and creditors have no reason to hound you for payment when there is no. If I settle debt, how long will it take for my credit report to be good again? · Your Credit Report can Bounce Back from the Impact of Settlement in Mere Months. One major advantage of debt settlement is that it accelerates the repayment process. Rather than stretching out payments over a lengthy period, you can possibly. Debt settlement is still a good option if you can't fully pay off your past-due debt. Settling a debt is much more beneficial to your credit and overall. When looking at debt relief options and solutions, keeping your credit score in mind is a good idea because you will want to work on rebuilding your credit. There are several situations where this may be a good option for the debt collector if they can get some of the money back and not have to pay court costs. PROS · You'll likely pay less and get out of debt faster. · If you've missed payments with your creditor, and are in collections, settling will eventually help. Paying off debt can seem impossible, but our Equifax Debt Management good and bad), and best practices for paying it off. Debt management is not.

Fha Loan With No Income

Though principally designed for lower-income borrowers, FHA loans are available to everyone, including those who can afford conventional mortgages. In general. Low down payments of as little as % of the home's purchase price with a credit score or higher · Low buyer credit scores · Higher debt-to-income ratio than. When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum. When it comes to the “minimum” amount the applicant. You do not need ANY credit score to obtain an FHA loan in the United States. FHA does not require it. You can provide other sources of proof. Some people erroneously believe that FHA Loans are for low-income borrowers, but in fact, there are no income restrictions for applying for an FHA Loan. The. There are technically no income limits, but you will need enough income to have acceptable DTI ratios. Having a higher income will not disqualify you from. you a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first home? FHA might be just what you. If you are unemployed for less than six months, you can qualify for an FHA loan 30 days after starting your new job. You need to show two pay check periods. A no-income-verification mortgage is a home loan that doesn't require the documentation that standard loans typically require like pay stubs, W2s or tax returns. Though principally designed for lower-income borrowers, FHA loans are available to everyone, including those who can afford conventional mortgages. In general. Low down payments of as little as % of the home's purchase price with a credit score or higher · Low buyer credit scores · Higher debt-to-income ratio than. When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum. When it comes to the “minimum” amount the applicant. You do not need ANY credit score to obtain an FHA loan in the United States. FHA does not require it. You can provide other sources of proof. Some people erroneously believe that FHA Loans are for low-income borrowers, but in fact, there are no income restrictions for applying for an FHA Loan. The. There are technically no income limits, but you will need enough income to have acceptable DTI ratios. Having a higher income will not disqualify you from. you a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first home? FHA might be just what you. If you are unemployed for less than six months, you can qualify for an FHA loan 30 days after starting your new job. You need to show two pay check periods. A no-income-verification mortgage is a home loan that doesn't require the documentation that standard loans typically require like pay stubs, W2s or tax returns.

Can I Get an FHA Loan Without a Job? You can get an FHA loan during a job gap, but you must have proof of steady income. How Much Can I Qualify For? “To be eligible for a mortgage, FHA does not require a minimum length of time that a borrower must have held a position of employment. However, the lender must. There are no income limitations because the FHA concentrates more on a borrower's ability to repay the loan. FHA guidelines focus on your repayment history, job. The FHA's backing makes it possible for you to qualify for a larger loan, even with a low income, meaning these are great first-time home buyer loans. FHA loans. Thankfully, the answer to these questions is yes, you can refinance or get a home loan without a job − although, you will need to satisfy some lender. A higher debt-to-income (DTI) ratio is allowed with an FHA loan. Borrowers can have monthly debt payments costing up to 50% of their income. Icon. Low Cost. You'll also need to have a debt-to-income ratio of 57 percent or less and a housing ratio of 31 percent or less. What's the difference between an FHA loan and a. KEY TAKEAWAYS · Getting a mortgage without a job is possible, but you must still demonstrate your ability to repay the loan by providing the lender with proof. FHA Loans are Assumable · FICOs scores as low as to be eligible for financing · Down payment as low as percent · Down payment can be a gift · Down payment. You must provide proof of steady income and employment in your FHA loan application, but the agency does not have specific maximum and minimum income. If you are self-employed, a first-time buyer, or a borrower with non-traditional credit, an FHA Loan may be perfect for you. FHA Loans have no income. For those who are self-employed, the FHA will require proof of two years of tax returns and an up-to-date balance sheet and profit and loss statement to qualify. FHA Streamline with no appraisal, no income, mortgage-only credit report. mortgage loan, the income may only be considered as a compensating factor. Borrowers will need to prove they will be able to pay back the loan in full before a lender will approve you. Lenders strongly consider your debt-to-income. For homeowners who may not have traditional income documentation, no-income-verification home equity loans offer a pathway to access the equity in their homes. Borrowers don't need to meet a minimum monthly income requirement to qualify for an FHA loan, and there's no maximum salary that will disqualify them either. If your earnings fluctuate, a no-doc mortgage can help you qualify without standard income documentation to prove you can repay the debt. FHA Loan · Select the Loan Purpose. If Refinance is selected, the Purpose of Refinance field will appear. Limited Cash Out is not a valid option for FHA loans in. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. FHA loan income requirements: 2-year job history. Another perk of FHA loans is that there are no income limits. That's good news if you're low on down.

Top Penny Stocks To Buy Right Now

NYSE Largest % Price Gain ; EAF · EAF · GrafTech International Ltd. $ ; NAIL · NAIL · Direxion Daily Homebuilders & Supplies Bull 3X Shares. $ ; WRBY. Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change · Faraday Future Intelligent Electric Inc - Ordinary Shares - Class A FFIE. Price. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · 100melochei.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. Yes, these are often the best cheap stock to buy even if they're called “penny stocks”. When you do your research, a term like penny stock shouldn't scare you. Top Penny Stock Gainers ; LGMK. LogicMark ; CNFR. Conifer Holdings ; GNLX. Genelux Corp. ; TANH. Tantech Holdings. A handful of stocks are flashing breakout signals and technical strength right now. This is neither a solicitation nor an offer to Buy/Sell futures or options. I'll reveal the smallest penny stocks to buy, the undiscovered ones and how to invest right now. Top 12 AI Stocks That Could SKYROCKET By With that said, profits from choosing penny stocks to buy now can significantly surpass gains in other investments if you pick the right securities. This is why. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. NYSE Largest % Price Gain ; EAF · EAF · GrafTech International Ltd. $ ; NAIL · NAIL · Direxion Daily Homebuilders & Supplies Bull 3X Shares. $ ; WRBY. Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change · Faraday Future Intelligent Electric Inc - Ordinary Shares - Class A FFIE. Price. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · 100melochei.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. Yes, these are often the best cheap stock to buy even if they're called “penny stocks”. When you do your research, a term like penny stock shouldn't scare you. Top Penny Stock Gainers ; LGMK. LogicMark ; CNFR. Conifer Holdings ; GNLX. Genelux Corp. ; TANH. Tantech Holdings. A handful of stocks are flashing breakout signals and technical strength right now. This is neither a solicitation nor an offer to Buy/Sell futures or options. I'll reveal the smallest penny stocks to buy, the undiscovered ones and how to invest right now. Top 12 AI Stocks That Could SKYROCKET By With that said, profits from choosing penny stocks to buy now can significantly surpass gains in other investments if you pick the right securities. This is why. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks.

Best Tech Penny Stocks · () · () · Sonim Technologies (NASDAQ:SONM) · () · FOXO Technologies (AMEX:FOXO) · Mobiquity Technologies (OTCPK:MOBQ) · Electra Battery. Now that you understand the basic benefits and risks of penny stocks, you can get deeper into how to buy penny stocks on a technical level. Choosing the right. Stock Screener Stock Ideas Volatile Penny Stocks. Most Volatile Penny Stocks Today. A list of the most volatile penny stocks listed on the NYSE or NASDAQ. Indian Overseas Bank One of the best penny stocks to buy in , Indian Overseas Bank operates within the banking sector. The Bank is divided into several. List of Penny Stocks ; Lypsa Gems & Jewellery Ltd, ₹, ; Ishan International Ltd, ₹, 5 ; DCM Financial Services Ltd, ₹, ; Future Market. Best penny stocks · iQIYI Inc. (IQ). · Geron Corp. (GERN). · 100melochei.ru (TBLA). · Archer Aviation Inc. (ACHR). · Navitas Semiconductor Corp. (NVTS). · Nuvation Bio. Zaw Thiha Tun is currently an investment advisor for PI Financial Corp. He is also a freelance financial writer on a wide variety of topics. Learn about our. List of The Best Penny Stocks Traded on the NASDAQ, NYSE, OTCQX, OTCQB & Pink Sheets. ; Top NASDAQ / NYSE Penny Stock List: · DNN, Denison Mines Corp. All Rights Reserved. Stock-Trak Inc. is the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate. Zaw Thiha Tun is currently an investment advisor for PI Financial Corp. He is also a freelance financial writer on a wide variety of topics. Learn about our. Given such a low share price, there is an understandable draw for retail investors who dream of buying cent shares and seeing them rise to ten or more times. The stock is currently trading at $ People that I told about this stock years ago are now saying, "Wow, I should have bought when you said to. Penny stocks to buy under $1 · $BTC Digital (100melochei.ru)$ · $Exela Technologies (100melochei.ru)$ · $ProQR Therapeutics (100melochei.ru)$ · $Cybin (100melochei.ru)$ · $Statera Biopharma . Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. Best penny stocks · 1. Compuage Info. , , , , , , , , , · 2. Brightcom Group, , , The Best Stocks Under $1 at a Glance ; NYSEAMERICAN: JOB. $ $m. , ; NASDAQ: AYLA. $ $m. 59, The stock is currently trading at $ People that I told about this stock years ago are now saying, "Wow, I should have bought when you said to. The best performing penny stock for this year is Comet Lithium (XTRRF) with a total return of 2,% over the past 12 months, followed by Real American. Penny stocks — US stocks ; EJH · D · USD, −% ; SOBR · D · USD, −% ; GDHG · D · USD, −% ; BNZI · D · USD, −%. " Some penny stock investors may buy tens of thousands of shares for a critical Sorry, we can't update your subscriptions right now. Please try.

United Mileageplus Cost

ANNUAL FEE. $0 intro annual fee for the first year, then $†. Signing up for the MileagePlus Shopping program is free, and it's easy to get started. Any United MileagePlus member can participate and there's no cost for. Miles transfers cost $ USD* per miles. *Plus, a processing fee of. In this article, we will compare the redemption rates of United MileagePlus and Air Canada Aeroplan to help you make an informed decision. MileagePlus is the award-winning loyalty program of United Airlines. Join MileagePlus to earn miles you can redeem for flights, upgrades and more. If you're eligible for a % bonus and maxed out this promotion, you'd receive a total of , miles at a cost of $3,, which is a rate of cents. United MileagePlus is the frequent flyer program for United Airlines. The You can buy 1, United miles at a cost of $35, plus taxes and fees. The. MileagePlus is the frequent flyer loyalty program of United Airlines. It is free to join and will enable you to earn MileagePlus miles by flying on United and. Premier Platinum/Gold/Silver members and United US Credit Card members: $ annual Membership ($40 savings off the standard CLEAR Plus rate). ANNUAL FEE. $0 intro annual fee for the first year, then $†. Signing up for the MileagePlus Shopping program is free, and it's easy to get started. Any United MileagePlus member can participate and there's no cost for. Miles transfers cost $ USD* per miles. *Plus, a processing fee of. In this article, we will compare the redemption rates of United MileagePlus and Air Canada Aeroplan to help you make an informed decision. MileagePlus is the award-winning loyalty program of United Airlines. Join MileagePlus to earn miles you can redeem for flights, upgrades and more. If you're eligible for a % bonus and maxed out this promotion, you'd receive a total of , miles at a cost of $3,, which is a rate of cents. United MileagePlus is the frequent flyer program for United Airlines. The You can buy 1, United miles at a cost of $35, plus taxes and fees. The. MileagePlus is the frequent flyer loyalty program of United Airlines. It is free to join and will enable you to earn MileagePlus miles by flying on United and. Premier Platinum/Gold/Silver members and United US Credit Card members: $ annual Membership ($40 savings off the standard CLEAR Plus rate).

For example, if you spend $5, internationally, you would avoid $ in foreign transaction fees. United Card Events from Chase and United MileagePlus. (cash price) - (taxes and fees) / (miles cost) = value per mile The travel world has deemed United miles to be worth around - cents each. So. What are the special rates for United MileagePlus® members? · Premier® 1K® members: Free annual membership · Premier Platinum/Gold/Silver members and United U.S. cost efficient than ever. In terms of best practices, United Airline's MileagePlus program provides a comprehensive example of loyalty partnership design. Prices start at $8 or miles for MileagePlus members. Shopping. MileagePlus Merchandise Awards. Shop for thousands of products like electronics, household. The cost and number of miles you can buy will depend on your flight details. You can buy up to , award miles per year using MileagePlus Personal Miles. I'm considering getting a UA MileagePlus Credit Card, specifically the Explorer card (the 2 United Club one-time passes per year is attractive plus the $0. To calculate the value of United MileagePlus miles, you need to subtract the taxes and fees from the cash price of your ticket and divide the difference by the. Basic members earn miles at a rate of five times the fare on flights, while Premier members can earn between seven and 11 times the fare price, depending on. Get started today. TSA PreCheck® is valid for 5 years. 11, United MileagePlus® miles covers the $78 application fee. Sign in. Within the 50 United States and Canada: $25 by phone, $30 at a City Ticket Office, $50 in person at the airport. Ticketing charges may vary outside the U.S. and. What are the special rates for United MileagePlus® members? · Premier® 1K® members: Free annual membership · Premier Platinum/Gold/Silver members and United U.S. You can find United's Polaris seats on these routes, but prices aren't cheap — you have to shell out , United miles for a one-way business-class ticket. Start your adventure. NO ANNUAL FEE. United GatewaySM Card. 20, bonus ; Make every trip rewarding. FREE CHECKED BAG. UnitedSM Explorer Card. 50, bonus. Generally, one United MileagePlus mile is valued at cents to each. This value is determined by dividing the cash ticket cost by the reward ticket cost. Use miles to pay your annual fee and United airfare via. Pay Yourself Back · Sign into your account here · Click on "More" on the top right corner of your account. MileagePlus is the frequent-flyer program of United Airlines that offers rewards to passengers traveling on certain types of tickets. Membership prices ; Premier Gold. $ or 85, miles ; Premier Platinum. $ or 85, miles ; Premier 1K · $ or 75, miles ; United ClubSM Infinite Card. To transfer miles to another account, you'll be charged $ per miles, plus a $30 processing fee. Members can transfer up to , miles from one. With a $ annual fee, this card is expensive but offers premium travel benefits including United Club membership (up to a $ value).

How To Set Stop Loss

Let's take a look at the following three methods you can use to determine where to set your stop losses. In futures trading, stop-loss refers to executing trades to close positions and limit further losses when the price reaches a certain level. Want to protect your position? Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Learn how they work. What are stop losses? Stop losses are exit orders that you can set to automatically close a position if it reaches a specified price that is worse than the. For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%. Suppose you just purchased Microsoft . · Stop loss orders are submitted in real-time on incoming executions from entry orders · Since they are submitted upon receiving an execution, the Set method. A stop-loss order is a market order that helps manage risk by closing your position once the instrument /asset reaches a certain price. If you want to place a stop-loss for an already open short or long position, you need to enter the Portfolio tab. LiteFinance: How to place a stop-loss order in. 1. Click the Position line on the chart to initiate the Stop order · 2. Drag the new order line to the desired price level · 3. This Sell-to-Close (Stop) Order. Let's take a look at the following three methods you can use to determine where to set your stop losses. In futures trading, stop-loss refers to executing trades to close positions and limit further losses when the price reaches a certain level. Want to protect your position? Stop orders may help you obtain a predetermined entry or exit price, limit a loss, or lock in a profit. Learn how they work. What are stop losses? Stop losses are exit orders that you can set to automatically close a position if it reaches a specified price that is worse than the. For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%. Suppose you just purchased Microsoft . · Stop loss orders are submitted in real-time on incoming executions from entry orders · Since they are submitted upon receiving an execution, the Set method. A stop-loss order is a market order that helps manage risk by closing your position once the instrument /asset reaches a certain price. If you want to place a stop-loss for an already open short or long position, you need to enter the Portfolio tab. LiteFinance: How to place a stop-loss order in. 1. Click the Position line on the chart to initiate the Stop order · 2. Drag the new order line to the desired price level · 3. This Sell-to-Close (Stop) Order.

By using a stop-loss order, a trader limits his risk in the trade to a set amount in the event that the market moves against him. Stop-loss Order theme. For. Some traders define it as an advance order, which triggers an automatic closure of an open position when the stock price reaches the trigger price level. Stop. A take-profit order is a type of limit order that specifies an exact price set by you. · A stop-loss order is used by traders to limit loss or lock in the. A stop loss is an order to automatically sell all or part of an investment when it drops to a certain price. Here's how to set one up. A stoploss is an order to buy or sell a security when it reaches a specific price to limit potential losses. Learn about SL, SL-M orders with examples. Learn how to place a stop-loss order and how traders use stop orders to either limit potential losses or to protect part of their trade profits. Usually, the one who wants to avoid a high risk of losses set the stop-loss order to 10% of the buy price. For example, if the stock is bought at Rs. and. What are Stop-Loss and Take-Profit orders? Stop-Loss and Take-Profit orders are trading features that instruct your broker to automatically reduce the size of a. A Stop Loss is an exit order, which is used to limit the amount of loss that a trader may take on a trade if the trade goes against him. Explore how to place a sell stop limit order using the All-In-One Trade Ticket®. Form the Order Type dropdown menu, select the STP or Stop order type. Now input your desired stop price. This is the price at which the order will activate. The limit offset/price is what is sent to the exchange after your stop price is triggered. Keep in mind that depending where you set your limit offset, prices. Steps Required to Set a Stop Loss · First, determine your maximum acceptable loss; · Set stop loss order levels based on sound technical levels; · Adjust your stop. Stop-Loss and Take-Profit are conditional orders that automatically place a mark or limit order when the mark price reaches a trigger price specified by the. SetStopLoss is a built-in stop reserved word that enables you to specify the amount of money you are willing to risk either on a total position basis, or a one. A stop loss order is an instruction to kill (end) a trade once a specific target is reached or exceeded. As the name suggests, the price a trade stops at is. The percentage-based stop uses a predetermined portion of the trader's account. For example, “2% of the account” is what a trader is willing to risk on a trade. A trader who prefers a more conservative strategy would place his stop outside the opposite outer Bollinger Band. Further reading: How to trade the Bollinger. Right Arrow Investing and Trading Right Arrow Basics Right Arrow Stop Loss How do I set the Stop Loss? To set a Stop Loss while you are opening a trade. Trailing stop-loss placement is usually specified by setting a price the desired distance away from the market price, in line with how much capital you're.

Free Puppy Insurance

Get your free pet insurance quote from our partners below. Nationwide: 100melochei.ru Fetch: https://www. Btw if your dog is AKC registered, they will come with a free insurance trial and a coupon that makes your frist vet visit free with in. The ASPCA® Pet Health Insurance program can help you avoid the heat of rising pet care costs by reimbursing up to 90% of eligible vet bills. If you have to take your pet to the vet, simply pay the covered vet bill and then make a claim with Paw Protect. Your policy covers you for virtually any. Where can I find free pet food and other pet supplies? What if I can't For help with future medical expenses, consider purchasing pet health insurance. Pet insurance premiums starting at $13/mo.* · Visit any licensed veterinarian in the United States · Cancel at any time, risk-free. Confidently send your puppies and kittens off to their new homes protected by the 6 weeks free introductory insurance cover, including up to €2, veterinary. Healthy Paws Pet Insurance for dogs & cats covers new accidents, illnesses, emergency care, and more with up to 90% back on vet bills. Get a free quote. Petplan's free temporary insurance helps pets settle into their new homes by making sure they're covered right from the beginning. Get your free pet insurance quote from our partners below. Nationwide: 100melochei.ru Fetch: https://www. Btw if your dog is AKC registered, they will come with a free insurance trial and a coupon that makes your frist vet visit free with in. The ASPCA® Pet Health Insurance program can help you avoid the heat of rising pet care costs by reimbursing up to 90% of eligible vet bills. If you have to take your pet to the vet, simply pay the covered vet bill and then make a claim with Paw Protect. Your policy covers you for virtually any. Where can I find free pet food and other pet supplies? What if I can't For help with future medical expenses, consider purchasing pet health insurance. Pet insurance premiums starting at $13/mo.* · Visit any licensed veterinarian in the United States · Cancel at any time, risk-free. Confidently send your puppies and kittens off to their new homes protected by the 6 weeks free introductory insurance cover, including up to €2, veterinary. Healthy Paws Pet Insurance for dogs & cats covers new accidents, illnesses, emergency care, and more with up to 90% back on vet bills. Get a free quote. Petplan's free temporary insurance helps pets settle into their new homes by making sure they're covered right from the beginning.

Our dog insurance provides comprehensive coverage and real-time vet payment. Protect your pup with the best insurance for dogs. Get a free quote today. You're free to use any licensed veterinarian in the United States or anywhere else in the world. Find the full list of coverage here. What. Spot Pet Insurance helps with unexpected vet bills from accidents and illnesses like human health insurance. Spot offers two plans for dog owners: accident &. cats covering up to 90% of your unexpected veterinary costs with no annual or lifetime payout limits and flexible coverage options. Start your free quote today. Pet Insurance from State Farm® & Trupanion® helps protect dogs, cats, and owners from the high costs of veterinary care. Get a free quote today. Members save 10% on monthly premiums for the lifetime of their pet's policy. Plans can cover qualifying care for injuries and illnesses, emergency vet visits. A pet health insurance policy reimburses the pet owner for specified veterinary care. · A pet life insurance policy covers end-of-life costs for your animal. Award-winning service. Check our prices. Insurance for the 21st century. Hassle-free digital experience. Lightning fast claims payment. Powered by AI. Get 5 weeks of Vetsure Pet Insurance completely FREE, and if you're happy, your cover will continue seamlessly. Redeem yours now. free visits whenever needed, and a 15% discount on additional services and meds. However, this does not cover unexpected expenses, and I'm. Get 30 days of pet health insurance to help cover unexpected veterinarian bills due to accidents or illness with this AKC registration certificate. Puppy Insurance. Unlimited 24/7 free access to FirstVet video consultations; Learning resources to guide you through puppyhood; No compulsory excesses or. Pet insurance is a policy that helps give peace of mind to pet owners. If your furry family member needs an exam, procedure or medication because they're. Pet health insurance typically protects you from financial losses when your pet gets into an accident or becomes ill. As with other types of insurance. The GEICO Insurance Agency can help you get comprehensive pet insurance coverage for your dogs and cats. Get a free online quote and see how affordable pet. Get 5 weeks free cover for your litters. · Earn rewards when new owners continue cover. · Access exclusive offers and discounts. Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote! Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate. Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness. Our 5-week free insurance is designed to protect your puppies when they leave for their new homes. The cover is activated by you, so you can have peace of mind.

How Does Debt Settlement Affect Credit Score

Debt settlement lowers credit scores, but not as much as defaulting and paying nothing. The exact damage to your credit score depends on where your credit score. While debt settlement will eventually result in accounts being paid, the lower score and history of missed payments will make it hard to find lenders. A settlement doesn't negatively affect your credit scores. There is absolutely no difference scorewise between paying in full or settling. A bankruptcy can also affect your credit score. In Chapter 7 bankruptcy, you liquidate assets to pay off as much debt as possible and any debt that is eligible. At the start, most debt consolidation methods have a negative effect on your credit score. They lower your score temporarily for several reasons. For example. Creditors will actually not settle with you unless you make late payments. These late payments have a negative impact on your credit score. In fact, on-time. Debt Settlement Will Most Likely Hurt Your Credit Score. Debt settlement is likely to lower your credit score by as much as points or more. But it's. A credit card debt settlement writes off a portion of what you owe, your credit score will go down because you didn't fully repay all of the money you borrowed. Yes, debt settlement does affect your credit and will show a settlement on your credit report. Some lenders could become leery or not willing to. Debt settlement lowers credit scores, but not as much as defaulting and paying nothing. The exact damage to your credit score depends on where your credit score. While debt settlement will eventually result in accounts being paid, the lower score and history of missed payments will make it hard to find lenders. A settlement doesn't negatively affect your credit scores. There is absolutely no difference scorewise between paying in full or settling. A bankruptcy can also affect your credit score. In Chapter 7 bankruptcy, you liquidate assets to pay off as much debt as possible and any debt that is eligible. At the start, most debt consolidation methods have a negative effect on your credit score. They lower your score temporarily for several reasons. For example. Creditors will actually not settle with you unless you make late payments. These late payments have a negative impact on your credit score. In fact, on-time. Debt Settlement Will Most Likely Hurt Your Credit Score. Debt settlement is likely to lower your credit score by as much as points or more. But it's. A credit card debt settlement writes off a portion of what you owe, your credit score will go down because you didn't fully repay all of the money you borrowed. Yes, debt settlement does affect your credit and will show a settlement on your credit report. Some lenders could become leery or not willing to.

Debt settlement can do long-lasting damage to your credit score, affecting your ability to get a loan, a credit card, or even housing or a job in the future. There might be a negative impact on your credit report and credit score. Debt settlement programs often ask — or encourage — you to stop sending payments. Yes. Debt settlement will negatively affect your credit score for up to seven years. That's because, to pressure your creditors to accept a settlement offer. debt. How does debt settlement affect your credit score? Debt settlement, like many debt relief programs, will in the vast majority of cases negatively. Debt consolidation has no significant impact on your credit rating. It is merely a way of simplifying your financial life and reducing the interest that you're. How does debt settlement impact my credit score? Because debt settlement companies advise consumers to stop making payments and purposely fall behind with. Do Settlements Hurt Your Credit Score? Debt settlement can give you some short-term financial relief, but it can also hurt your credit score and make it more. Credit score impact: Debt settlement companies often advise their clients to stop paying creditors. Missing payments profoundly impacts credit scores — causing. “Consolidating debts does not have a direct impact on your credit scores, but it can be a helpful way to protect your financial standing,” says Rod Griffin. What does debt settlement do to your credit score? Debt settlement can potentially impact your ability to get credit. This is because a debt settled at a. Because you may have to stop making your payments on your credit cards, debt settlement results in a temporary negative impact to your FICO credit scores and. Regardless of how a debt is resolved, the adverse notation is not a "life sentence" to having bad credit. As the notation gets older, it's impact on the score. Negative impact to your credit score: There's no way getting around it — debt settlement will ultimately hurt your credit score. That can make it difficult to. Debt consolidation: Your credit score could benefit in the short term if consolidating significantly lowers your credit utilization rate, which accounts for 30%. So, each debt you settle will damage your credit score. But if your accounts are already in collections, they already count negative remarks on your credit. Yes. Debt settlement will negatively affect your credit score for up to seven years. That's because, to pressure your creditors to accept a settlement offer. You will usually pay less than you owe and become debt free in a shorter amount of time. As you settle your debts, your credit score should start to recover. Getting debts settled improves your debt-to-income ratio, which is one of the strongest influences on your credit score. How debt consolidation can affect your credit If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a.

72t Early Retirement

Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called "early" or "premature" distributions. 72(t)(2)(H)Distributionsfrom Retirement Plans in Case of Birth of Child or Adoption Any qualified birth or adoption distribution. The aggregate amount which. Rule 72(t) is a section of the IRS code that covers the exceptions and processes that allow you to withdraw your retirement funds early and without penalty. Most retirement plans require you to wait until age 59 and 1/2 to make withdrawals without penalty, but IRS Rule 72T makes an important exemption for those that. To help fund an early retirement or to tap into retirement savings prior to age 59½ and avoid the early distribution penalty, investors may be able to take. Providing an early retirement bridge is probably the most common use. You 72(t) DISTRIBUTIONS. 1 The premature distribution penalty-tax is 25% if. Learn how to withdraw funds from your retirement accounts before age 59½ without penalty. Discover the 72(t) rule and the Rule of 55, and their limitations. Early Withdrawals without Penalty. The IRS has a rule for an early retirement withdrawal tax exemption called a 72(t), associated with a “Substantially Equally. The Internal Revenue Code sections 72(t) and 72(q) allow for penalty free early withdrawals from retirement accounts. The IRS limits how much can be. Generally, the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called "early" or "premature" distributions. 72(t)(2)(H)Distributionsfrom Retirement Plans in Case of Birth of Child or Adoption Any qualified birth or adoption distribution. The aggregate amount which. Rule 72(t) is a section of the IRS code that covers the exceptions and processes that allow you to withdraw your retirement funds early and without penalty. Most retirement plans require you to wait until age 59 and 1/2 to make withdrawals without penalty, but IRS Rule 72T makes an important exemption for those that. To help fund an early retirement or to tap into retirement savings prior to age 59½ and avoid the early distribution penalty, investors may be able to take. Providing an early retirement bridge is probably the most common use. You 72(t) DISTRIBUTIONS. 1 The premature distribution penalty-tax is 25% if. Learn how to withdraw funds from your retirement accounts before age 59½ without penalty. Discover the 72(t) rule and the Rule of 55, and their limitations. Early Withdrawals without Penalty. The IRS has a rule for an early retirement withdrawal tax exemption called a 72(t), associated with a “Substantially Equally. The Internal Revenue Code sections 72(t) and 72(q) allow for penalty free early withdrawals from retirement accounts. The IRS limits how much can be.

Taking early withdrawals from retirement accounts · Part of a series of substantially equal periodic payments made at least annually · Calculated according to one. Internal Revenue Code (IRC) Section 72(t)(2)(A)(iv) defines these distributions as “Substantially Equal Periodic Payments”. The IRS has approved three ways to. The IRS Rule 72T allows for penalty free, early withdrawals from retirement accounts. This calculator provides an advanced analysis of the 72(t) exception. The Internal Revenue Code section 72(t) and 72(q) can allow for penalty free early withdrawals from retirement accounts under certain circumstances. Use this calculator to determine your allowable 72(t)/(q) Distribution and how it may be able to help fund your early retirement. The IRS rules regarding 72(t)/. 72(t) Distributions - Substantially Equal Periodic Payments. The IRS Rule 72T allows for penalty free, early withdrawals from retirement accounts. This. Simply stated, IRC Section 72(t) allows you to avoid the 10% early withdrawal penalty for withdrawals prior to 59&1/ Rule 72(t) provides several ways to. Rule 72(t) allows you to withdraw money from your IRA penalty free to supplement your income if you are out of a job or in early retirement. 72(t) payments are a series of substantially equal periodic payments made from an IRA that can be used to avoid the 10% penalty for early distributions. By using the IRS rule 72(t), it ELIMINATES the 10% early withdrawal penalty normally due for withdrawals prior to age 59/ Here's how it works: Let's say you. The Internal Revenue Service (IRS) has a rule called 72(t), and by using the 72(t) rule, it eliminates the 10% early withdrawal penalty normally due for. Taking Distributions Before Age 59 ½ · Allows withdrawals from retirement savings without the 10% early withdrawal penalty · Maintains the tax-deferred status of. Rule 72t. Rule 72t allows you take substantially equal periodic payments (SEPPs) from your accounts free of penalty. No disability, death, or unemployment. The IRS typically imposes a 10% early withdrawal penalty on distributions from a retirement account before the age of 59½. However, under certain circumstances. You don't setup 72t payments from all pretax account's total balance, but a single account. This gives you some control over the account balance. Withdrawing from a retirement account early isn't ideal, but sometimes it's the only option for early retirees. The 72(t) method allows you to take penalty-free. Rule 72(t) refers to a section of the IRS code outlining instances where early withdrawals from qualified retirement accounts such as IRAs, (k)s, and (b)s. The 72(t) Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10% early. Rule 72(t) allows you to access your retirement savings without penalty before age 59 ½. But, although the rule provides flexibility to tap into retirement. It is an IRS guideline exception also allowing avoidance of a 10% penalty for early withdrawal but only if you leave your job after you turn 55 or often times.