100melochei.ru

News

When Selling House What Costs Involved

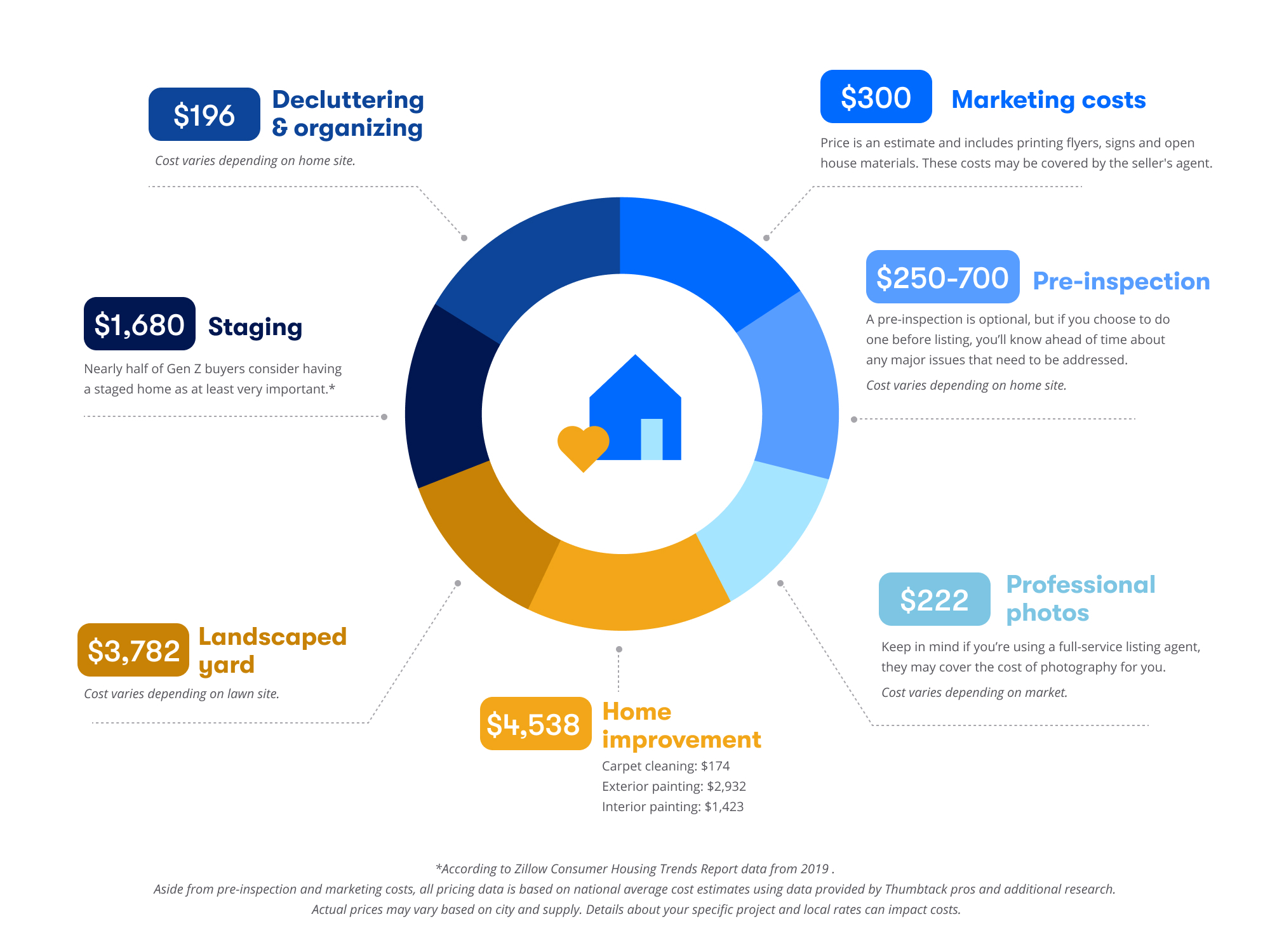

Closing costs are the administrative fees that come with your sale/purchase of a property. They're called closing costs because they happen on closing day. The average cost of selling a house by owner is about 7% of the sale price, but this varies depending on the location and price of the home. FSBO Costs vs. the commission you agreed to pay your real estate licensee's brokerage;; the legal fees to discharge any existing mortgage;; legal or notary fees for title. When a home is sold, there are closing costs associated with the sale. Seller Closing costs will be charged whether you use a Real Estate Agent or sell the. Key Takeaways · Costs associated with selling a home include real estate agent commissions and potential tax on profits. · Sellers typically pay real estate agent. Get a protection plan on all your appliances · Real estate commission · Home staging costs · Loan payoff fees · Earn cash back on everyday purchases with this rare. 1. The inspection and repairs The buyer, at their expense, frequently obtains an inspection report on your property, and the sale is often conditional on the. Main costs associated with selling a home. The average cost to sell a house usually adds up to about % of the sale price. Below is a breakdown of some of. Hidden Costs of Selling Your Home · legal/notarial fees for handling the sales transaction · disbursements or out-of-pocket expenses incurred by the lawyer or. Closing costs are the administrative fees that come with your sale/purchase of a property. They're called closing costs because they happen on closing day. The average cost of selling a house by owner is about 7% of the sale price, but this varies depending on the location and price of the home. FSBO Costs vs. the commission you agreed to pay your real estate licensee's brokerage;; the legal fees to discharge any existing mortgage;; legal or notary fees for title. When a home is sold, there are closing costs associated with the sale. Seller Closing costs will be charged whether you use a Real Estate Agent or sell the. Key Takeaways · Costs associated with selling a home include real estate agent commissions and potential tax on profits. · Sellers typically pay real estate agent. Get a protection plan on all your appliances · Real estate commission · Home staging costs · Loan payoff fees · Earn cash back on everyday purchases with this rare. 1. The inspection and repairs The buyer, at their expense, frequently obtains an inspection report on your property, and the sale is often conditional on the. Main costs associated with selling a home. The average cost to sell a house usually adds up to about % of the sale price. Below is a breakdown of some of. Hidden Costs of Selling Your Home · legal/notarial fees for handling the sales transaction · disbursements or out-of-pocket expenses incurred by the lawyer or.

Sellers usually pay, on average, % of the home's total selling price in closing costs in addition to the professional fee paid to their agent. Before putting your house on the market, ensure that you're financially prepared to cover everything from closing costs to the home staging bill. When you sell a property, the estate agent working on your behalf will charge for its service. This fee - known as commission - is expressed as a percentage of. Here's a look at all the hidden costs of selling a house, including agents fees (which may be changing soon), repairs, staging and closing costs. Sellers need to pay GST, legal fees, real estate costs, property taxes, and more. These costs can cut into your selling price, diminishing how much you earn. This can include staging, carpet cleaning, interior painting, landscaping and general repairs. If you're in a buyer's market with more homes for sale than there. Here's a breakdown — including the tax implications of selling a home — so you can figure out how much you'll need, and if you're ready to sell your home. The cost of selling a house varies, but sellers can expect to pay between 10% and 15% of the home's sale price. If you're selling a home for $, and you're paying your real estate agent 6%, then in commissions, you would have paid $15, Again, note that your. You may also be responsible for paying a flat fee to the brokerage that listed your house This fee covers all the administrative costs involved when listing and. Finally, make sure to budget for other miscellaneous expenses associated with selling your home. For instance, you will be responsible for paying all property. Before closing, your lawyer will give you a full breakdown of any other selling costs, which may include outstanding property taxes, utilities or condo fees if. The current seller's market may provide potential advantages as a home seller, including more power at the negotiating table on selling costs; nevertheless, you. When you add on commissions, taxes, and fees, it can easily cost anywhere from 6% – 8% of the value of a home to sell a house. Despite the creation of Zillow. Mortgage discharge fees and break fees on a sale typically cost between $ and $1, Home loan fees & costs. We're here to help you understand yoru home. Many of the closing costs involved in real estate transactions are also necessary to facilitate the sale, so the parties involved must settle them. Closing. How Much Does It Cost To Sell A Home? · Brokerage Fees / Real Estate Commissions · Seller Concessions · Title Search Cost · Instrument Survey Cost · Home Warranty. Real estate commissions, title company fees, transfer fees with the county or similar jurisdiction, property tax and insurance impound account fees. If you are planning to sell your home, you'll want to know the costs involved. Other than your mortgage, it's advisable to spend roughly 10% of your home's. Your listing agent commission usually covers online listing fees, professional photography and videography, advertising on social media and open house expenses.

Citibank Credit Card Eligibility Check

The Citi Simplicity Card is issued on the Mastercard network and provides Cardmembers with exceptional value through its low intro APR, no late fees, no. If you cannot find the Citi Mobile app, you can SMS “CITIMOB” to Alternatively, you can log on to Citibank Online, log in with your user ID and password. Apply online for a Citi credit card that fits you: whether you want travel points or cash back, low-rate balance transfers, or to build your credit score. You will need a personal FICO score of or higher to qualify for a Citi business credit card. This does not apply to standalone corporate card accounts. Is a. Citibank has its own internal eligibility criteria for its credit card schemes. They are based on your salary, the place you work, the company you work for. Learn how to save and get rewarded for everyday purchases like gas, groceries, and paying your AT&T bill. Sign up and apply today for the AT&T Points Plus. Compare and apply for one of Citi's no annual fee credit cards. Choose from a variety of benefits like cash back rewards and low intro APR – all with no. Existing Cardmembers. The quickest way to manage your account is the 24/7 self-service options through Citibank: Online: Check your balance, view. This offer will be fulfilled as 20, ThankYou® Points, which can be redeemed for $ cash back. 5% eligible categories: Restaurants, gas stations, grocery. The Citi Simplicity Card is issued on the Mastercard network and provides Cardmembers with exceptional value through its low intro APR, no late fees, no. If you cannot find the Citi Mobile app, you can SMS “CITIMOB” to Alternatively, you can log on to Citibank Online, log in with your user ID and password. Apply online for a Citi credit card that fits you: whether you want travel points or cash back, low-rate balance transfers, or to build your credit score. You will need a personal FICO score of or higher to qualify for a Citi business credit card. This does not apply to standalone corporate card accounts. Is a. Citibank has its own internal eligibility criteria for its credit card schemes. They are based on your salary, the place you work, the company you work for. Learn how to save and get rewarded for everyday purchases like gas, groceries, and paying your AT&T bill. Sign up and apply today for the AT&T Points Plus. Compare and apply for one of Citi's no annual fee credit cards. Choose from a variety of benefits like cash back rewards and low intro APR – all with no. Existing Cardmembers. The quickest way to manage your account is the 24/7 self-service options through Citibank: Online: Check your balance, view. This offer will be fulfilled as 20, ThankYou® Points, which can be redeemed for $ cash back. 5% eligible categories: Restaurants, gas stations, grocery.

All Citi credit cards which display the Visa or Mastercard logo and Citibank Debit Cards which display the Mastercard logo are eligible. However, Citi. Select takes a look at the Citi Custom Cash Card, which offers cardholders 5% cash back in their top eligible spending category. Offer ends 9/3/ My Best Buy Credit Cards Apply now · View pricing & terms. Already have the Card? Make payments, check your balance. In your Amazon wallet, select the monthly payment plan under your eligible Citi card that works best for you. When you place your order, the total purchase. CITI® SECURED MASTERCARD® PROGRAM DETAILS To receive a Citi® Secured Mastercard®, you must meet our credit qualification criteria, which includes a review of. 0% Intro APR Credit Cards Offers available if you apply here today. Offers may vary and these offers may not be available in other places where the cards are. Citibank offers multiple banking services that help you find the right credit cards, open a bank account for checking, & savings, or apply for mortgage. Locate Branch · Open a Checking, CD, Credit Card or Lending Account · Forgot Password · View Bank Account Rates. Quick and easy. At checkout, select your eligible Citi credit card as your payment method and choose your monthly payment option. No application needed. The credit card reward certificate, or alternative-form distribution, will contain your cash back rewards balance based on your eligible purchases during the. 1. Visit Citibank Online on your desktop, laptop or mobile and click on the 'Credit Cards' tab in the menu bar. 2. From the drop-down menu that appears, click. Apply today and discover the benefits your new card has to offer. 0% Intro APR Credit Cards Offers available if you apply here today. Offers may vary and these offers may not be available in other places where the cards are. With Citi ThankYou® Rewards you can earn ThankYou® Points and redeem them for great rewards like gift cards, electronics and travel rewards. A Citi Flex Loan leverages the existing credit line on your Citi credit card, so there's no application, credit inquiry or origination fee. Applying for a Citi Credit Card – Things to keep in mind · Credit Score and Discrepancies in your Credit Report. Credit Score is a key parameter used by banks to. Citi Custom Cash® Card · Citi Double Cash® Card · Citi® / AAdvantage® Executive World Elite Mastercard® · Citi Rewards+® Card · Citi® Diamond Preferred® Card · Citi. A good travel credit card (or a few) is a tool that all financially responsible travelers should be using. However, knowing which travel credit card(s) to apply. If your credit card account is closed for any reason, these benefits will be cancelled. Eligible Citi® / AAdvantage® primary credit cardmembers may check. Not that this answers your question but four cards in eight months of credit history is very high velocity and by the time you are eligible to.

Lowest Apr Debt Consolidation

Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. This example is an estimate only and assumes all payments are made on time. 3Online Bill Payment is only available for members 18 or older. As low as % APR*. Loan amounts from $1, - $50, · APRs from % - % with loan terms of 3 or 5 years · Won't affect your credit score · You can have funds in as fast as 1. A SoFi credit card consolidation loan could help lower monthly payments. · Lower interest rates. Save money by securing a lower fixed APR. · Simplified payments. APR = Annual Percentage Rate. Advertised rate is lowest offered and includes a% rate discount for automatic payments for the life of the loan. APR is based. With rates from % to % APR, we could help you save money on higher-rate interest and pay off your debt sooner. Which consolidation option is right for. SoFi Personal Loan. Best for Good credit ; Upgrade. Best for Best overall ; LightStream. Best for Low rates ; Happy Money. Best for Paying off credit card debt. The best debt consolidation loans are from LightStream, which has an APR range of % - %, does not charge an origination fee, and offers the possibility. Consolidate debt and see what your monthly payment would be with the Wells Fargo debt consolidation calculator With Personal Loan rates as low as % APR. Simplify your finances by consolidating higher-interest debt with Personal Loan rates as low as % APR. This example is an estimate only and assumes all payments are made on time. 3Online Bill Payment is only available for members 18 or older. As low as % APR*. Loan amounts from $1, - $50, · APRs from % - % with loan terms of 3 or 5 years · Won't affect your credit score · You can have funds in as fast as 1. A SoFi credit card consolidation loan could help lower monthly payments. · Lower interest rates. Save money by securing a lower fixed APR. · Simplified payments. APR = Annual Percentage Rate. Advertised rate is lowest offered and includes a% rate discount for automatic payments for the life of the loan. APR is based. With rates from % to % APR, we could help you save money on higher-rate interest and pay off your debt sooner. Which consolidation option is right for. SoFi Personal Loan. Best for Good credit ; Upgrade. Best for Best overall ; LightStream. Best for Low rates ; Happy Money. Best for Paying off credit card debt. The best debt consolidation loans are from LightStream, which has an APR range of % - %, does not charge an origination fee, and offers the possibility. Consolidate debt and see what your monthly payment would be with the Wells Fargo debt consolidation calculator With Personal Loan rates as low as % APR.

Freedom Federal Credit Union is offering debt consolidation loans with a rate as low as a % APR. Take back control, turn your pile of bills into 1 low. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. Borrow up to $10,, for as low as % APR* with our Personal Loan Special. Competitive rates for all outstanding debt such as: Personal Loans -. Use our debt consolidation calculator to estimate your potential savings. The lowest APR shown is available to applicants with excellent credit and. The lowest rate available, % APR, is also among the lowest from these providers, but the maximum rate, % APR, ties Upgrade for the highest. While most. loan from Telhio, with rates lower than most credit cards! Apply Now. Personal Loan Rate. Rate as Low as. APR as Low as. Rate as Low as. %. APR as Low as. Truliant debt consolidation loans help members combine debt into a single loan and pay off others loans. This helps them to concentrate on paying down debt with. Debt consolidation loans through Upstart are the best if you need a low APR. Loans through Upstart can have APRs as low as %, depending on your overall. Some of the best no-interest credit cards that offer balance transfers are the Citi Simplicity® Card (see rates and fees) and the U.S. Bank Visa® Platinum Card. Compare debt consolidation loan rates from top lenders for September ; LendingClub · Rates from (APR). % · Loan term. 2 - 5 years ; LendingClub. The lowest APR is available on loans of $10, or more with a term of months, a credit score of or greater and includes discount for automatic. SoFi. Best debt consolidation loan. APRs. % to %*. You can prepay your debt consolidation loan at any time with no fee or penalty. We've helped more than 3 million customers⁶. Akilah, a happy Upstart customer. Debt Consolidation Loans for Bad Credit in September ; Upstart logo · · % - % · 36 or 60 months · $1, to $50, ; prosper logo · · % -. A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month —. A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. Credit card refinancing involves transferring your debt onto a new balance transfer credit card with an interest rate as low as 0%. This introductory rate is. The Interest on a debt consolidation loan should go for somewhere between 6% and 20%. Debt consolidation loans are offered by banks, credit unions and online. Consumers with credit scores of or higher get the best interest rates on debt consolidation loans. The farther down the scale your credit score is, the.

Defiyieldprotocol

DeFi Yield Protocol (DYP) (Founded in ) is a cryptocurrency platform that allows users to provide liquidity and be rewarded with Ethereum. DeFi Yield Protocol is a DeFi Yield Farming with Automated Vaults. Chainlink Ecosystem delivers the latest news and information about integrations and. Fixed-rate lending for DeFi. Interest rates shown are market rates and are subject to change. Your rate may vary based on the amount borrowed. - The current DYP price is per (DYP/USD). DeFi Yield Protocol is % rise the all time high of $ The current circulating supply is. DeFi Yield Protocol Quick Project Information. Dypius is a powerful, decentralized ecosystem with a focus on scalability, security, and global adoption through. As we mentioned before, DeFi Yield Protocol was created to offer fair treatment to all our users so that all of them can benefit from our anti-. DeFi Yield Protocol is a platform that offers solutions for yield farming, staking, NFTs, and enabling users to leverage the advanced trading tools of the DYP. The current market price today of DeFi Yield Protocol is USD and is over the last 24 hours, and over the last 7 days. Yield Protocol (YIELD) price has increased today. The price of Yield Protocol (YIELD) is $ today with a hour trading volume of $12, This. DeFi Yield Protocol (DYP) (Founded in ) is a cryptocurrency platform that allows users to provide liquidity and be rewarded with Ethereum. DeFi Yield Protocol is a DeFi Yield Farming with Automated Vaults. Chainlink Ecosystem delivers the latest news and information about integrations and. Fixed-rate lending for DeFi. Interest rates shown are market rates and are subject to change. Your rate may vary based on the amount borrowed. - The current DYP price is per (DYP/USD). DeFi Yield Protocol is % rise the all time high of $ The current circulating supply is. DeFi Yield Protocol Quick Project Information. Dypius is a powerful, decentralized ecosystem with a focus on scalability, security, and global adoption through. As we mentioned before, DeFi Yield Protocol was created to offer fair treatment to all our users so that all of them can benefit from our anti-. DeFi Yield Protocol is a platform that offers solutions for yield farming, staking, NFTs, and enabling users to leverage the advanced trading tools of the DYP. The current market price today of DeFi Yield Protocol is USD and is over the last 24 hours, and over the last 7 days. Yield Protocol (YIELD) price has increased today. The price of Yield Protocol (YIELD) is $ today with a hour trading volume of $12, This.

We're excited to welcome DeFi Yield Protocol (DYP) to our DeFi Innovation Zone today! DYP joins + other DeFi assets on Poloniex. We're excited to welcome DeFi Yield Protocol (DYP) to our DeFi Innovation Zone today! DYP joins + other DeFi assets on Poloniex. DeFi Yield Protocol (DYP) is a token and operates on the Ethereum platform. The current market price of DeFi Yield Protocol is £ British pound and is. About DYP's Anti-Manipulation feature. DeFi Yield Protocol (DYP) works to curb the influence of large whale users. The protocol employs an anti-. DeFi Yield Protocol offers solutions for yield farming, staking, NFTs, and enabling users to leverage the trading tools of the DYP. The current price of DeFi Yield Protocol is $, with a market capitalization of $ thousand. Approximately DYP were exchanged. The DeFi Yield Protocol (DYP) is a unique platform that allows virtually any user to provide liquidity, receive rewards in ETH for the first time since DeFi. View the live Dypius [Old] - DeFi Yield Protocol price, market capitalization value, real-time charts, trades and volumes. Create notifications and alerts. The protocol uses a smart contract to determine and alter the APR in other cases. Some protocols, such as Yearn Finance, look at various yield farming. The DeFi Yield Protocol (DYP) is a unique platform that offers solutions for yield farming, staking, NFTs, and enabling users to leverage the advanced trading. Yield Protocol is an open source platform allowing anybody to create and execute yield farming & trading strategies on the Ethereum Defi ecosystem. The DeFi Yield Protocol price today is $ USD with a 24 hour trading volume of $K USD. DeFi Yield Protocol (DYP) is up % in the last 24 hours. For trading DeFi Yield Protocol (DYP), there are 14 pairs available on 5 exchanges. With hour total trading volumes of $M and $K, Coinbase Pro. DeFi Yield Protocol is an official project token that corresponds to the DeFi category. The project's token smart-contract has been audited by 1 security. The current price of DeFi Yield Protocol (DYP) is USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out. Aug 18, - The live price of Defi Yield Protocol is $ DYP price has increased by % in 24hrs, with a market cap of $M. Download Fast And Secure DeFi Yield Protocol Wallet App For Mobile - IOS And Android - And Desktop. Buy, Sell And Swap Dyp And + Cryptos In One Secure. DeFi Yield Protocol has emerged as one of the fastest-growing crypto projects with an expanding ecosystem. DYP allows DeFi users to leverage advanced. Create a free account on MEXC Crypto Exchange via website or the app to buy DeFi Yield Protocol Coin. Your MEXC account is the easiest gateway into buying. Fully Diluted Valuation $5,, ; API ID defi-yield-protocol copy duigou ; Project Start Date - ; Related News · Coinbase to List $DYP, $ALEPH, $HOPR, $MATH, $.

Sweep Investment

:max_bytes(150000):strip_icc()/sweepaccount.asp-Final-e0b16e87c6be4879a9376eec7787c292.png)

Clients with investment accounts serviced by a J.P. Morgan Advisor can earn a return on available cash balances by choosing to automatically sweep these. They developed instead, the sweep account, an investment instrument distinct from the demand account, but which could pay competitive interest rates within the. With our Automated Investment Sweep service, you can transform idle balances into hardworking investments and make the most of your organization's funds. Domestic Morgan Stanley Money Market Sweep Investment3 Yields as of 09/11/ ; Morgan Stanley Institutional Liquidity Funds (MSILF) Government Securities. Learn more about investing solutions from Ameriprise Financial that provide easy cash access and opportunities to earn interest or dividends on uninvested. Our Cash Sweep Program automatically “sweeps” uninvested cash balances into a Cash Sweep Option until such balances are invested or otherwise used to satisfy. Wells Fargo Advisors offers a sweep feature with three options for clients to earn a return on uninvested cash balances in their account. Sweep investment A sweep investment, or sweep investment account, is a secondary bank account or type of sweep account that offers additional investment. Make the most of your excess cash by moving those funds overnight and earning a high rate of interest with Investment Sweeps from First National Bank. Clients with investment accounts serviced by a J.P. Morgan Advisor can earn a return on available cash balances by choosing to automatically sweep these. They developed instead, the sweep account, an investment instrument distinct from the demand account, but which could pay competitive interest rates within the. With our Automated Investment Sweep service, you can transform idle balances into hardworking investments and make the most of your organization's funds. Domestic Morgan Stanley Money Market Sweep Investment3 Yields as of 09/11/ ; Morgan Stanley Institutional Liquidity Funds (MSILF) Government Securities. Learn more about investing solutions from Ameriprise Financial that provide easy cash access and opportunities to earn interest or dividends on uninvested. Our Cash Sweep Program automatically “sweeps” uninvested cash balances into a Cash Sweep Option until such balances are invested or otherwise used to satisfy. Wells Fargo Advisors offers a sweep feature with three options for clients to earn a return on uninvested cash balances in their account. Sweep investment A sweep investment, or sweep investment account, is a secondary bank account or type of sweep account that offers additional investment. Make the most of your excess cash by moving those funds overnight and earning a high rate of interest with Investment Sweeps from First National Bank.

This higher-yielding investment option is often a money market fund, which yields higher interest rates than a standard bank account. If the balance in the. We offer liquid investment vehicles through passive sweep services that enable you to begin earning interest immediately while your funds remain liquid. The portfolios in the Schwab Intelligent Portfolios® program include a cash allocation, which differs depending on the investment strategy selected. A sweep account is a specialty bank account set up to retain a certain cash balance for immediate business expenses; any excess funds are automatically swept. Schwab One Interest and Bank Sweep are the two primary cash features. The Money Fund Sweep is an additional cash feature available to certain accounts. A sweep account automatically transfers, or “sweeps,” money from one account into another, with the goal of earning a higher rate of return. Provident's Tiered Sweep Investment Account works directly with your commercial checking account. Maximize earnings on excess cash by contacting us today. PNC helps businesses with sweep accounts, short term investments, liquidity management, idle cash balance return, investment accounts and lines of credit. Investment Sweep - Transfers checking account balances in excess of your specified target balance into an investment instrument that earns a competitive. Cash Sweep is a program designed to hold cash balances awaiting investment. Through the program, the brokerage account cash balance from deposits. A sweep account is an account set up at a bank or other financial institution where the funds are automatically managed between a primary cash account and. Accounts that have the Merrill Lynch Direct Deposit Program and are enrolled in Merrill Guided Investing, an investment advisory program, will receive the. Ultimate Sweep. In times of excess liquidity when your LOC is paid to a zero balance, with an ultimate sweep your excess funds transfer to an investment option. Deposit products and services are provided by City National Bank Member FDIC. City National Rochdale, LLC is a SEC-registered investment adviser and wholly-. Sweep Option Yields. Brokerage Accounts. Symbol, Fund Description, 7-Day SEC Investments in alternative investment strategies is speculative, often. Enroll in an investment sweep account with M&T Bank for automated deposits of excess funds through your choice of overnight or net investment service. You make deposits, write checks, wire funds, etc., and we automatically transfer funds to and from your sweep investment account on a daily basis. Our sweeps. PNC Investments Bank Deposit Sweep Program or BDSP uses bank's computers analyze customer use of checkable deposits and sweep funds into money market. With the Sweep Investment Account, you can have excess operating funds from a checking account automatically invested into an overnight Repurchase Agreement. Huntington's Automated Funds Investment (AFI) saves you time by automatically sweeping excess funds above your target balance into the investment option of.

Amber Coin

Item description from the seller. Vintage Fostoria Amber Coin Glass 32 Oz Pitcher. Excellent ++ condition. No chips or cracks. Current AmberCoin (AMBER) token data: Price $ , Trading Volume $ , Market Cap $ , Circ. Supply, Total Supply M. Official links to websites. View the live AmberCoin price, market capitalization value, real-time charts, trades and volumes. Create notifications and alerts. The oldest coins found in the Latvian territory came from ancient Rome by way of the so-called Amber Route and were paid for with amber. The routes of such. Coin Glass Amber. Coin Glass Amber. View as Grid List. 1 Item. Show. 12, 24, per page. Sort By. Position, Product Name, Price, UPC, Sign Edge. Set. Buy Baltic Amber Coin Cultured Petal Pearl Gold-Filled Chain Necklace: Pendant - 100melochei.ru ✓ FREE DELIVERY possible on eligible purchases. The live Amber Soul Stone price today is $ USD with a hour trading volume of $0 USD. We update our AMBER to USD price in real-time. Check out our fostoria amber coin selection for the very best in unique or custom, handmade pieces from our collectible glass shops. AmberDAO (AMBER) is worth $ today, which is a % increase from an hour ago and a % decline since yesterday. The value of AMBER today is % lower. Item description from the seller. Vintage Fostoria Amber Coin Glass 32 Oz Pitcher. Excellent ++ condition. No chips or cracks. Current AmberCoin (AMBER) token data: Price $ , Trading Volume $ , Market Cap $ , Circ. Supply, Total Supply M. Official links to websites. View the live AmberCoin price, market capitalization value, real-time charts, trades and volumes. Create notifications and alerts. The oldest coins found in the Latvian territory came from ancient Rome by way of the so-called Amber Route and were paid for with amber. The routes of such. Coin Glass Amber. Coin Glass Amber. View as Grid List. 1 Item. Show. 12, 24, per page. Sort By. Position, Product Name, Price, UPC, Sign Edge. Set. Buy Baltic Amber Coin Cultured Petal Pearl Gold-Filled Chain Necklace: Pendant - 100melochei.ru ✓ FREE DELIVERY possible on eligible purchases. The live Amber Soul Stone price today is $ USD with a hour trading volume of $0 USD. We update our AMBER to USD price in real-time. Check out our fostoria amber coin selection for the very best in unique or custom, handmade pieces from our collectible glass shops. AmberDAO (AMBER) is worth $ today, which is a % increase from an hour ago and a % decline since yesterday. The value of AMBER today is % lower.

Track current Amber Chain prices in real-time with historical AMBER USD charts, liquidity, and volume. Get top exchanges, markets, and more. Get NORTH GOLDEN AMBER COIN from Richardson Beer & Wine, Richardson, TX for $ According to our AmberCoin price prediction, AMBER is forecasted to trade within a price range of $ and $ next year. AmberCoin will increase. Shop Coin Glass Amber Crystal & Glasses by Fostoria at Replacements, Ltd. Explore new and retired china, crystal, silver, and collectible patterns. AmberCoin is a cryptocurrency that is backed by real assets. AmberCoin is an example of using the blockchain technology for managing the industrial company's. Calculate Ambercoin (AMBER) mining profitability in realtime based on hashrate, power consumption and electricity cost. AMBER exchange rates, mining pools. The card holder wallet James Dixon Botón Racing Amber features a coin pocket, a side snap button, and is made in Switzerland. - The live price of AMBER is $0 with a market cap of $0 USD. Discover current price, trading volume, historical data, AMBER news, and more. Baltic Amber and Castle Dome turquoise, suspended from sterling silver wire. " IBISwoman jewelry is handcrafted and designed in Lindsborg, KS. AmberCoin - the first crypto currency that is backed by real assets. AmberCoin is an example of using the blockchain technology for managing the industrial. 24x22mm Coin Czech Glass Lamp Work coin, Venetian style. Sold by piece. Color: dark amber glass with copper color finishes. Categories. Czech Glass Beads. Amber Coin is a power. This card can also be obtained from Dark Frontier Card Packs. Diamond Chests and Dark Frontier Card Packs can give Premium versions. AMBER price has plummeted by % in the last day, and decreased by % in the last 7 days. It's important to note that current AmberCoin market. Tiaria Glass Crystal Amber coin Beads 18mm faceted twisted per 8-in-str-Tiaria.. Chinese Crystal Twisted Coin Faceted Beads.. Imitated Swarovski. List of all AmberCoin (AMBER) exchanges, where you can buy, sell and trade AMBER, how to buy instructions, live prices, and trade volumes from more than 6. Buy Czech Glass Matte Glowing Amber Coin 14mm at Lima Beads in our Czech Glass online store. Czech glass beads are known for their sparkling cuts and. Golden Amber Coin by North Brewing Company is a IPA - Sour which has a rating of 4 out of 5, with ratings and reviews on Untappd. All AmberCoin (AMBER) markets from every crypto exchange. List ranked by trading volume. Compare live rates, prices and volumes for your next trade. Amber Linear Coin Pocket - Retrospect · Write a Review · Shipping & Returns · Footer Start. Information. About Us. Download Coinbase Wallet to buy and sell Amber Soul Stone on the most secure crypto exchange. Trade Amber Soul Stone. Amber Soul Stone is climbing this week.

Best Website For Penny Stock News

The only penny stocks site recommended in Barron's and by Forbes, picks penny stocks trading at under $5 a share that are on the NYSE, NASDAQ, and AMEX. Trading penny stocks. Are you considering penny stocks? Here is what you need to know. Fidelity Active Investor. Canadian and USA Penny Stocks and small cap info, quotes, news, charts, most actives, weekly North American market information, portfolio management tools. Penny Stocks App for iPhone is use to find hot penny stocks ideas. Penny Stocks allows a trader to find daily top penny stocks gainers and losers. The Best Penny Stock Picks, News & Information are on 100melochei.ru Penny Stocks (100melochei.ru) is the top online destination for all things Micro-Cap. E*TRADE has best-in-class mobile apps and desktop trading platforms that are all well-designed and easy to use, and this experience translates to penny stock. Gevo (GEVO): Hedge Funds Are Bullish On This Green Energy Penny Stock Now. We recently compiled a list of the 10 Best Green Energy Penny Stocks to Buy Now. Welcome to 100melochei.ru Penny Stocks (100melochei.ru) is the top online destination for all things Micro-Cap Stocks. On 100melochei.ru you will find a. Find the latest news about PENNY STOCKS. View the PENNY STOCKS news and updates for today, Investment news based on TipRanks market-leading research tools. The only penny stocks site recommended in Barron's and by Forbes, picks penny stocks trading at under $5 a share that are on the NYSE, NASDAQ, and AMEX. Trading penny stocks. Are you considering penny stocks? Here is what you need to know. Fidelity Active Investor. Canadian and USA Penny Stocks and small cap info, quotes, news, charts, most actives, weekly North American market information, portfolio management tools. Penny Stocks App for iPhone is use to find hot penny stocks ideas. Penny Stocks allows a trader to find daily top penny stocks gainers and losers. The Best Penny Stock Picks, News & Information are on 100melochei.ru Penny Stocks (100melochei.ru) is the top online destination for all things Micro-Cap. E*TRADE has best-in-class mobile apps and desktop trading platforms that are all well-designed and easy to use, and this experience translates to penny stock. Gevo (GEVO): Hedge Funds Are Bullish On This Green Energy Penny Stock Now. We recently compiled a list of the 10 Best Green Energy Penny Stocks to Buy Now. Welcome to 100melochei.ru Penny Stocks (100melochei.ru) is the top online destination for all things Micro-Cap Stocks. On 100melochei.ru you will find a. Find the latest news about PENNY STOCKS. View the PENNY STOCKS news and updates for today, Investment news based on TipRanks market-leading research tools.

I would then recommend finviz. The ones in the menu of this sub also are real good Happy hunting. Penny stocks are incredibly dangerous investments that can burn new and seasoned investors alike. InvestorPlace's best micro-cap analysts recommend buying. Founded in , Insider Monkey is a finance website that uses a proprietary strategy to identify the best stock picks from exceptional hedge funds and insiders. This OTC Market News Service, is the Top Free Penny Stock Newsletter! Traders have seen huge gains on Penny Stock Alerts released from our Newsletter Email. This page provides a list of penny stocks (those trading between and ) sorted by the highest 5-day percent change. These high-volatility stocks. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. An online trading account can provide you with the opportunity to speculate on the prices of penny stocks. You can open a trading account to gain access to our. Since trading costs, such as commissions and processing fees, are the primary determinants for a good penny stock broker, we chose Fidelity as our top overall. Penny Stocks App for android is use to find hot penny stocks ideas and top penny stocks today. Penny Stock Screener allows a trader to find daily top penny. OTC (over the counter) directly between brokers. The OTC Markets Group operates an electronic Bulletin Board to buy and sell penny stocks. This is the most. r/pennystocks: A place to lose money with friends and likewise degenerates. The posts and advice here should be taken with caution, this is not. The only penny stocks site recommended in Barron's and by Forbes. ; Voxware, $ to $, % ; Corvas, $ to $, % ; Cytogen, $ to $, The best brokers for penny stock trading include Fidelity, Interactive Brokers, Charles Schwab and TradeStation. Fidelity is one of the most. Penny Stocks (100melochei.ru) is the top online destination for all things Micro-Cap Stocks. top penny stock news, and micro-cap stock articles. ChoiceTrade: ChoiceTrade, which trades penny stocks on the Over the Counter Bulletin Board (OTCBB) and Pink Sheet markets, offers two pricing tiers. NYSE. Best penny stocks · iQIYI Inc. (IQ) · Geron Corp. (GERN) · 100melochei.ru (TBLA) · Archer Aviation Inc. (ACHR) · Navitas Semiconductor Corp. (NVTS) · Nuvation Bio Inc.. The Bullish Bears team scans for the leading gappers each morning and filters our penny stocks watch list down to three to five stocks. We look at the highest. The Best Penny Stocks · ASRT · BDSI · SBEV · AUMN · NGD · LCLP · TONR · AHFD. A stock with a lot of volatility like Marin Software Inc (NASDAQ: MRIN) is a good bet for the most promising penny stock. Remember, we're traders, not investors. The best stock tracker for penny stocks. With the penny stock market, you get education, innovation, and support that helps you simplify investing and learn.

Current Rate For Home Equity Line Of Credit

Current HELOC Rates ; $25, % ; $50, % ; $, % ; $, %. Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Home Equity Rates ; SoLo Home Equity Line · $50, - $, · ≤80% LTV · % fixed for the first 12 months then Prime Minus % · % ; Home Equity Line. Fixed rates with % origination fee and no discounts range between % and % APR and are subject to change at any time. Rate offers additional loan. Home Equity Loans are fixed-rate loans. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio. As of August 21, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. Current HELOC Rates ; $25, % ; $50, % ; $, % ; $, %. Check today's home equity loan rates ; Up to 80% LTV, % ; % - % LTV, % ; % - % LTV, % ; % - % LTV, %. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. Home Equity Rates ; SoLo Home Equity Line · $50, - $, · ≤80% LTV · % fixed for the first 12 months then Prime Minus % · % ; Home Equity Line. Fixed rates with % origination fee and no discounts range between % and % APR and are subject to change at any time. Rate offers additional loan. Home Equity Loans are fixed-rate loans. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio. As of August 21, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %.

Loan Payment Example: A $20, fixed rate home equity loan at % APR* for a month term would have a $ monthly payment. Loan Calculators. What Works. *All home equity rates are based on your credit history, current credit report and loan to value ratio. The HELOC is a variable rate loan. All loans are. For a limited time, take advantage of our % introductory annual percentage rate (APR) for the first six billing cycles from account opening. Certain limitations apply. Lines of credit are subject to credit approval. For Home Equity Lines of Credit: Variable Annual Percentage Rate (APR) can be as low. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. The loanDepot HELOC has a variable interest rate based on an index (WSJ Prime Rate) plus a margin set by the lender. Your APR will not exceed % at any time. You can fix a portion of that amount, say $10, at a lower fixed rate for a five to 20 year term. The remaining $15, is still available to you at the. The average HELOC rate today ranges between 8% and 10%. When compiling our list of best HELOC options, we took into account various factors, with the APR being. As of 8/2/, the WSJ Prime Rate is %. Current rates across all markets range from Prime + % (currently %) to Prime + % (currently %). Payments are calculated based on the previous month's balance and the current rate. • At the end of the initial draw period, you can request a draw period. % · Up to % · Up to % · Get more with a Bank of America Home Equity Line of Credit · What can a HELOC help you do? Current Prime Rate is % as of July 27, Depending on customer's qualifications, variable APR's range for line amounts as stated above. Customer's. Home Equity Line of Credit features variable rates based on the Prime Rate published each day in The Wall Street Journal Money Rates Table (the "Index"), plus a. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Rates range from % APR to % APR and are subject to change at any time. Lowest rate assumes a credit limit of $50, or more, loan to value (LTV). The average HELOC rate today ranges between 8% and 10%. When compiling our list of best HELOC options, we took into account various factors, with the APR being. Get % APR introductory rate for 6 months. · What you get with our Home Equity Line of Credit: · What are HELOC Rates today? Home Equity Line of Credit 85% Loan Value Rates ; $15, or less. Prime +%. %. $ ; $15, – $50, Prime + %. %. $ ; Over $50, APR is variable and subject to change monthly but cannot exceed 18%, and the APR will never fall below % for HELOC 70%, % for HELOC 80%, % for HELOC. See today's home equity loan rates from Discover Home Loans. Tap into your home equity with $0 application fees, $0 origination fees, $0 appraisal fees.

Quick Cash Apps Like Dave

Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these. Brigit. Similar to Dave, Brigit offers cash advances of up to $ with more flexible terms. On your first loan, you will be given a one. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. You'll receive your funds within days, or you can get them within an hour if you pay a fast-funding fee, which ranges from $ to $ Dave also. Beem (formerly Line) is better than any instant cash advance app, payday loan, personal loan and credit products. Subscribe to withdraw verified bank deposits. Best Overall, Best for Fast Funding With a Low Fee: Varo · Runner-Up Best Overall, Best for Flexible Loan Amounts: Payactiv · Also Good for Flexible Loan Amounts. Beem (formerly Line) is better than any instant cash advance app, payday loan, personal loan and credit products. Subscribe to withdraw verified bank deposits. 5. FlexWage Like the other payday loan alternatives, it also helps the employees to access the wages based on their demands. This app provides instant cash. 10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an. Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these. Brigit. Similar to Dave, Brigit offers cash advances of up to $ with more flexible terms. On your first loan, you will be given a one. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. You'll receive your funds within days, or you can get them within an hour if you pay a fast-funding fee, which ranges from $ to $ Dave also. Beem (formerly Line) is better than any instant cash advance app, payday loan, personal loan and credit products. Subscribe to withdraw verified bank deposits. Best Overall, Best for Fast Funding With a Low Fee: Varo · Runner-Up Best Overall, Best for Flexible Loan Amounts: Payactiv · Also Good for Flexible Loan Amounts. Beem (formerly Line) is better than any instant cash advance app, payday loan, personal loan and credit products. Subscribe to withdraw verified bank deposits. 5. FlexWage Like the other payday loan alternatives, it also helps the employees to access the wages based on their demands. This app provides instant cash. 10 cash advance apps to borrow against your next paycheck · EarnIn: Best for those who need immediate access to their paycheck · Pros · Cons · Current: Best for an.

Discover 21 best cash apps like dave including Birgit, Solo Funds, Money Lion, Klover and more.

2. Brigit Brigit is another excellent cash advance app that offers Instant Cash advances of up to $ To enjoy Brigit's features, which include overdraft. It takes only minutes to download the Dave app, securely link your bank, and send the money to a Dave Checking account. Express fees apply to instant. Discover 21 best cash apps like dave including Birgit, Solo Funds, Money Lion, Klover and more. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. The Dave app provides a well-organized procedure for obtaining a payday loan. You may apply for a significant portion of your previously earned monthly income. Cash Advance Apps Similar to Dave · 1. Albert · 2. Earnin · 3. Brigit · 4. Cash App · 5. Empower · 6. FloatMe · 7. Grid · 8. Klover – Instant Cash Advance. To qualify, you must open an ExtraCash™ account and pay a $1 monthly subscription fee. Depending on your loan amount, instant transfers cost up to $ Dave. Dave: Best for flexible funding options · Loan amount: Up to $ · Subscription fee: $1 · Speed without paying a fee: business days · Speed with fast-funding. Some of the best alternative apps like Moneylion and Dave include Brigit, Chime, and Pocketly, which offer similar features like cash advances, budgeting tools. 15 Cash Advance Apps Like Dave for · Dave is one of the most popular financial apps. · EarnIn is unique on this list, as it lets customers access the money. Albert: Smart Budgeting & Instant Cash Albert gives cash advances of up to $ along with tools for budgeting and saving to assist in improving your. Dave lets you borrow up to $ instantly, which can help cover larger expenses like your car breaking down or paying rent tomorrow. You also slowly build your. Additionally, Dave App offers the convenience of interest-free cash advances, providing a safety net for unexpected expenses. In essence, Dave App is a valuable. Brigit is a loan app like Dave that offers secured personal loans to build your credit history. Its Instant Cash feature offers a $ advance for qualifying. 1. Varo. Cash Advance: Up to $; Speed: Instant; Fees: Up to $15, depending on the amount borrowed; Our Rating. Rather than fronting you the money like most paycheck advance apps, DailyPay gives access to what you've already earned. The app keeps track of your working. EarnIn is a cash advance app that links to your checking account and work time sheet to receive quick advances you repay on your next pay date. Payments for. Brigit. Similar to Dave, Brigit offers cash advances of up to $ with more flexible terms. On your first loan, you will be given a one.

How Long Is A Sr22 Required In California

You do not need to refile each year. As long as: Your insurance company doesn't drop you after it issues your SR22; You don't cancel the. The length of time you will need to have an SR certificate on file depends on many factors. However, the typical time limit averages three years. Of course. In California, you are required to keep your SR for at least three years. Canceling your insurance, lapsing when you switch carriers, or failing to pay for. How Long Must I Have SR Coverage? Typically, you must carry SR coverage for three years. Once the court says you no longer need it, contact your insurer. How Long Do SR22 Last in California? The duration of SR22 can vary depending on your state. SR insurance requirements last up to 3 years. Drivers caught. How Long Do I Need the SR22 in Place? In most cases, you will need an active SR22 form filed with the California DMV for at least 3 years after a DUI suspension. Such events can require you to have your insurance company file an SR22 with the DMV for up to three years. Your insurance policy should cover all cars you. Drivers need to maintain SR status for three years after a DUI. Our attorneys explain SR after a DUI in California. Contact us for help today. Continuing Your Current SR You must maintain your SR requirement for the duration specified by the state where the DUI occurred, which in. You do not need to refile each year. As long as: Your insurance company doesn't drop you after it issues your SR22; You don't cancel the. The length of time you will need to have an SR certificate on file depends on many factors. However, the typical time limit averages three years. Of course. In California, you are required to keep your SR for at least three years. Canceling your insurance, lapsing when you switch carriers, or failing to pay for. How Long Must I Have SR Coverage? Typically, you must carry SR coverage for three years. Once the court says you no longer need it, contact your insurer. How Long Do SR22 Last in California? The duration of SR22 can vary depending on your state. SR insurance requirements last up to 3 years. Drivers caught. How Long Do I Need the SR22 in Place? In most cases, you will need an active SR22 form filed with the California DMV for at least 3 years after a DUI suspension. Such events can require you to have your insurance company file an SR22 with the DMV for up to three years. Your insurance policy should cover all cars you. Drivers need to maintain SR status for three years after a DUI. Our attorneys explain SR after a DUI in California. Contact us for help today. Continuing Your Current SR You must maintain your SR requirement for the duration specified by the state where the DUI occurred, which in.

What Is the Time Period for a California SR? Generally speaking, a CA SR is required for three years for most violations. Depending on your record and. A DMV authorization letter, if you are a cash depositor or are self-insured. California Proof of Insurance Certificate (SR 22) form for broad coverage or. How long do I need SR in California? An SR will be required for three to five years. This demonstrates to the DMV that you are maintaining at least. It is mandatory under California law to carry auto insurance. If you cannot secure an SR22 on your own, the authorities will offer you a program that matches. The California “Certificate of Financial Responsibility” or SR22 is required for a three-year probation period. During this time a driver is required to. Most people will have to carry California SR22 insurance for three years or less. The amount of time required depends on the severity of the violation. You'll. How Do You Get SR Insurance in California? · After receiving a DUI or charged with any other high-risk violations, you must file an SR · The SR form. In most cases, you'll need to maintain your SR22 filing for three years from the date your license suspension ends. However, this can vary depending on the. In most cases, 36 months from the date you are eligible to get your license back. Can you file an SR22 on my behalf in a state outside of California? Yes, if. Minimum Liability Insurance Requirements for Private Passenger, Commercial and Fleet Vehicles · $15, for injury/death to one person. · $30, for injury/death. On average, the California Department of Motor Vehicles requires SRs to be carried and maintained for at least three years. More severe convictions, like. Any of these things will be needed for you to buy a file of SR22 California, and it has a normal period of 3 years. Also, if the DMV asks for the maintenance of. How Long Do I Need SR Insurance? In California, you are generally required to carry SR insurance for three years. It's crucial to maintain continuous. How long do I need SR for in California? You'll typically need an SR for three to five years. This lets the DMV know that you are maintaining at least. However, there are some cases where you may need to keep an SR22 policy for as long as ten years or more. This is usually for drivers facing severe violations. In California, the minimum filing period is three years, but depending on the reason for the SR, it can be required for up to five years. You are also. If you have had your driver's license suspended for any reason, then you need an SR Not all insurance companies provide SR policies. Once you have gotten. ONCE MANDATED, HOW LONG IS THE SR22 REQUIRED IN THE STATE OF CALIFORNIA? This is one of the most frequently asked questions regarding the California SR Contact your state's department of motor vehicles to find out the exact length of time you'll need to carry an SR — in most states, it's three years. How do.